Hello Crypthon

Executive Summary

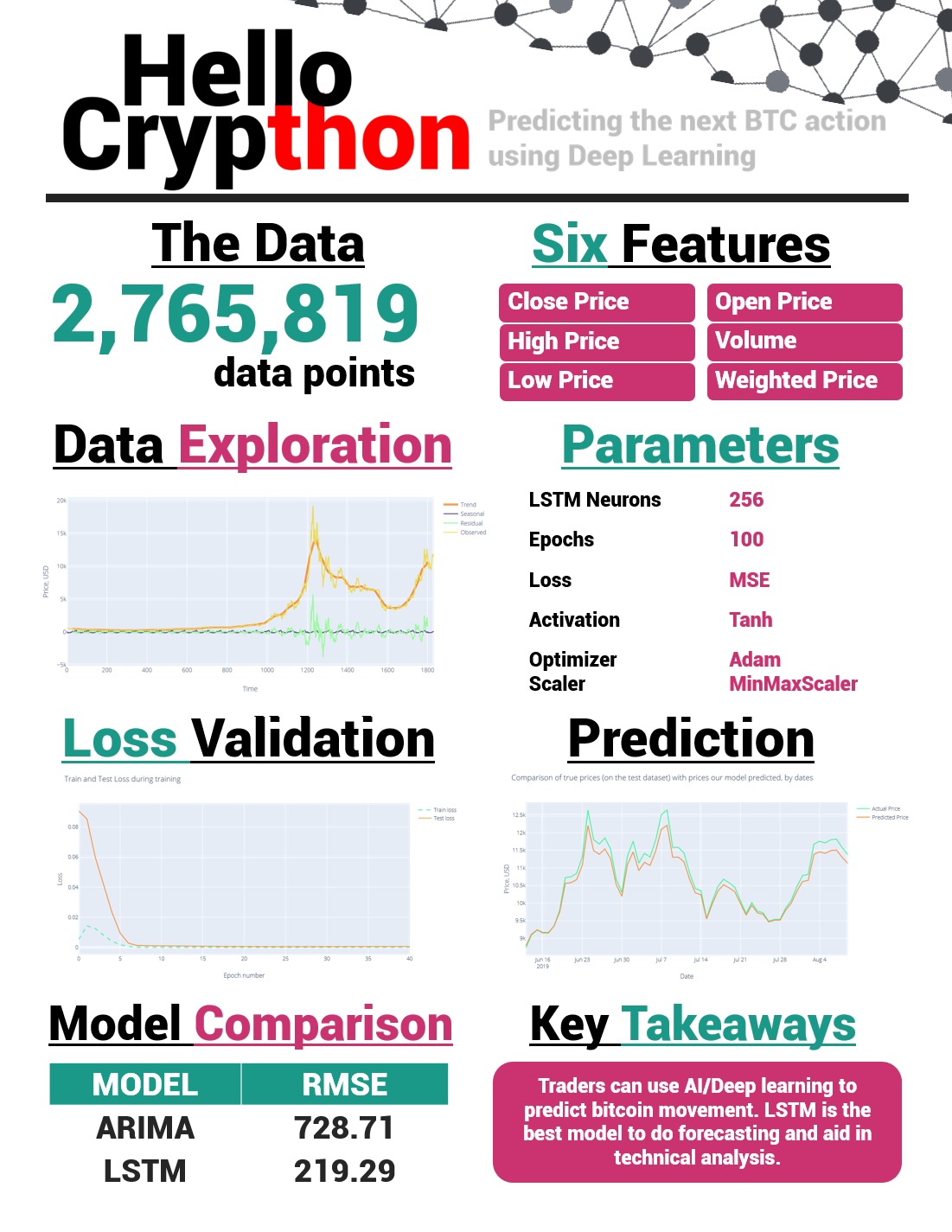

After the extreme movements of cryptocurrencies’ prices in recent years, Bitcoin has been increasingly regarded as an investment asset. Because of its highly volatile nature, there is a need for good predictions on which to base investment decisions in case the crypto is traded actively again. Bitcoin is the first decentralized digital currency. Thus, this is not governed by any central bank or some other authority. Created in 2009 and became popular in 2017, experts would call bitcoin “the currency of the future” or even lead it as an example of the social revolution. Many economic entities are interested in tools for forecasting the bitcoin prices given its volatile nature. And as many investors are trapped given what had transpired since 2018 where bitcoin suddenly dropped, bitcoin movement prediction is indeed critical.

Given the said problem, this Study intends to test and recommend a Machine/Deep Learning approach in predicting bitcoin movements given a certain period of historical performance. Bitcoin historical dataset from kaggle and yahoo finance was used for analysis.

The models compared include Autoregressive Integrated Moving Average (ARIMA), Gated Recurrent Unit (GRU) and Long short-term memory (LSTM). LSTM was identified as the best model with least Root Mean Square Error (RMSE) of 219.29 and least training time of 127 seconds. For further studies, Bidirectional LSTM and stacked LSTM with more layers are recommended.

Note: For the technical paper (PDF), data and the code used in this project, you may send me an email or you can also drop your message via LinkedIn.